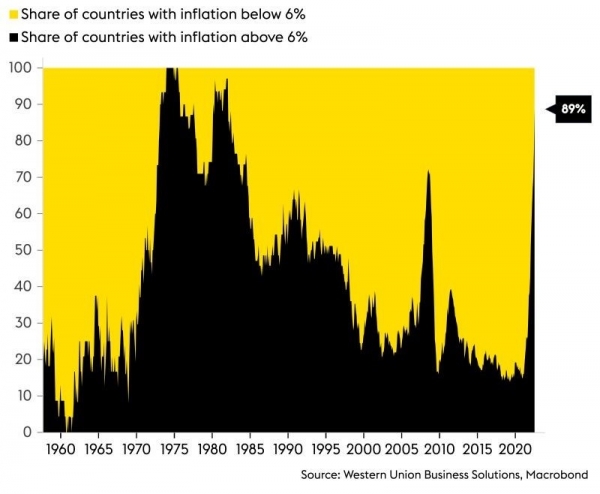

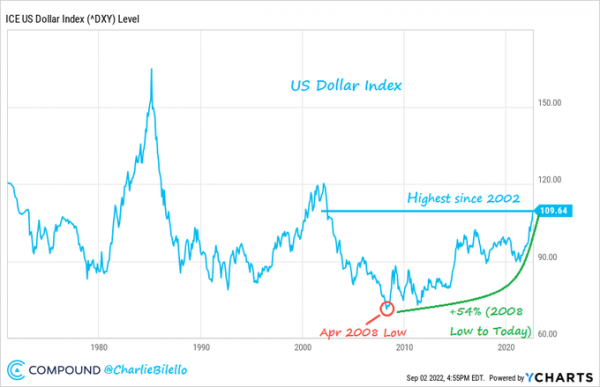

During the month of August, the major central banks (Fed, ECB, etc.) emphasised their determination to control inflation, despite the inherent risks to the growth outlook (see item n°2). This resolutely restrictive tone weighed on the performance of equity and bond markets (see articles n°6 and n°7).

The focus on fighting inflation at the expense of growth was made clear in Powell's Jackson Hole speech. The Fed Chairman also issued a clear warning to the American public: prepare for hard times. For Powell, reducing inflationary pressures will likely require an extended period of below-trend growth. While much of the inflation is supply-driven, it is the Fed's responsibility to reduce demand to restore price balance, he said.

Market expectations for US interest rates have been revised upwards throughout August. The yield curve now anticipates a 75 basis point rise in September, followed by a 50 basis point rise in November and a 25 basis point rise in December.

The tone adopted by the European Central Bank (ECB) has also become more hawkish. The market now assigns a probability of almost 100% for a 75 basis point hike in September, followed by another 50 basis points in October.

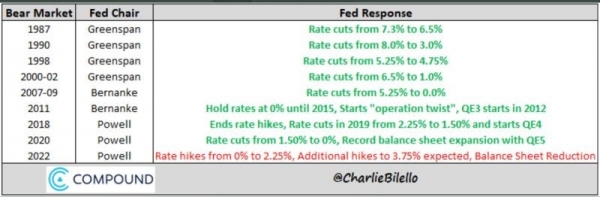

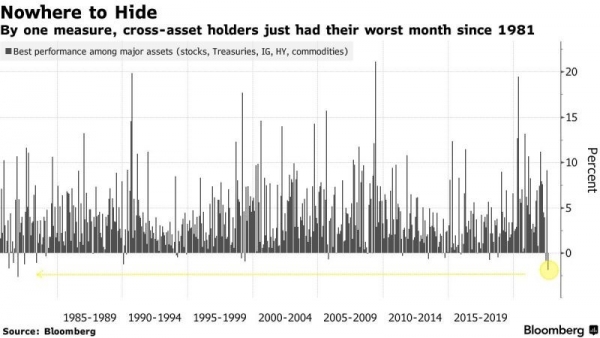

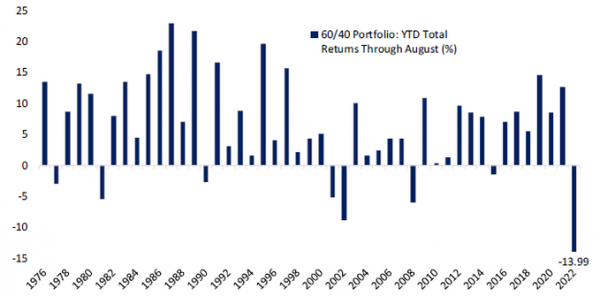

It is very rare to experience periods of monetary policy tightening when stock markets are falling. In the previous eight bear markets, the Fed's bias was decidedly expansionary (rate cuts, QE, etc.). This is not the case with the current bear market. The last historical equivalent (bear market with rate hikes) was in the early 1980s under Volcker.)