Many economists were expecting a non-event. The latest inflation figures suggested a rather balanced message from Fed Chairman Jay Powell. He was expected to be an "iron fist in a velvet glove", i.e. firm on the continuation of monetary tightening but also showing some signs that the Fed is ready to slow down the rate hikes if the economic data (inflation as well as growth) justify it.

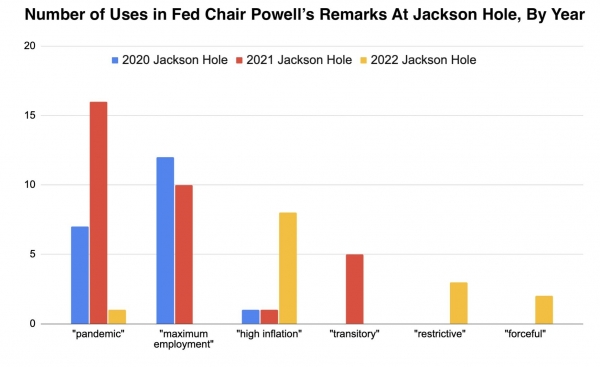

However, Jay Powell's very short speech - 10 minutes as opposed to the usual half hour - was interpreted as a hawkish one, i.e. resolutely turned towards a longer and more important monetary tightening than the market had hoped for.

Quoting both former central bankers Paul Volcker and Alan Greenspan, Jerome Powell presented his speech in the form of 3 distinct lessons:

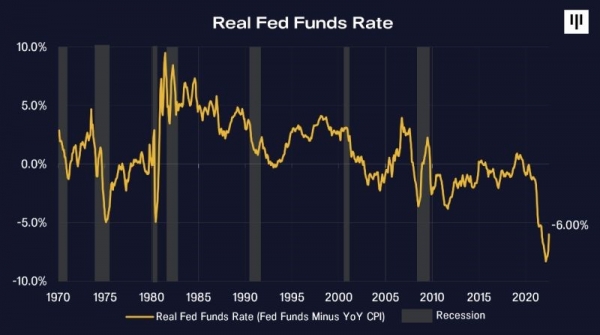

1) It is up to central bankers to take responsibility for low and stable inflation (in other words, there is no inevitability. Even if the supply deficit is the main cause of rising inflation, the central bank must act on demand to bring inflation down);

2) Public expectations of future inflation can play an important role in determining the future path of inflation. Jerome Powell also mentioned that "inflation is on almost everybody's mind right now, which highlights the risk that the longer the current episode of high inflation continues, the more likely it is that expectations of higher inflation will take hold. In a way, this is a wake-up call that shows that the Fed is very determined to carry out its mission to bring inflation back towards the central bank's objective (2%);

3) The Fed must continue its efforts until the job is done, underlining - once again - the determination of the US central bank to control rapid price growth.

Jay Powell added that continued tight monetary policy is likely to be necessary for some time and that history "warns against premature easing" of monetary policy.

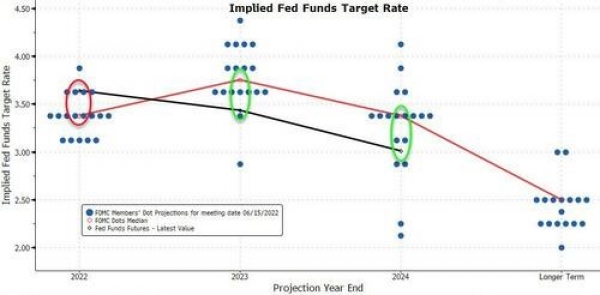

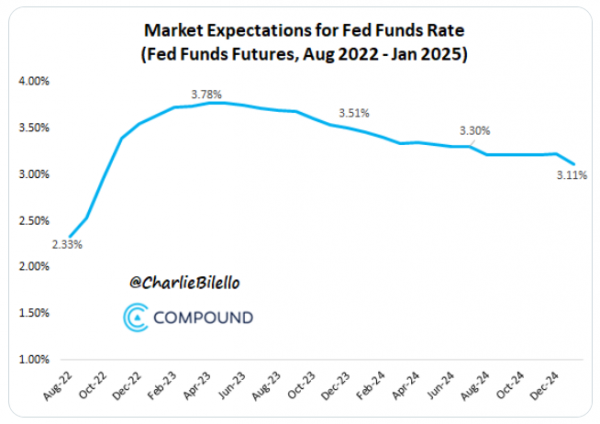

In conclusion, Mr Powell tried to convince investors that the rate cuts in 2023 that are currently expected by the market are too optimistic. As the chart below shows, the dichotomy between the Fed's projections and those of the market was striking before Jackson Hole. For its part, the Fed intends to raise rates for a relatively long period of time with no intention of lowering them anytime soon. However, the markets were expecting very short-term rate hikes that will give way to rate cuts as early as 2023.