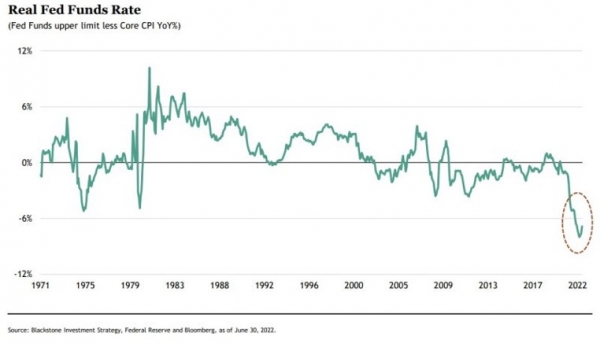

We had almost become accustomed to the fact that the days when US inflation figures are published almost automatically translate into a down session for the US stock market. Since the end of the Covid-19 phase, the figures have continually surprised on the upside, reaching a peak of 9.1% in June.

The mood changed last Wednesday; for the first time in 18 months, the US inflation figures for July surprised (finally) on the downside. On a rolling 12-month basis, the inflation rate was "only" 8.5%. On a sequential basis, inflation is no longer rising. This is a good surprise for the financial markets because a slowdown in price increases could imply that the coming monetary tightening will be less severe than expected.

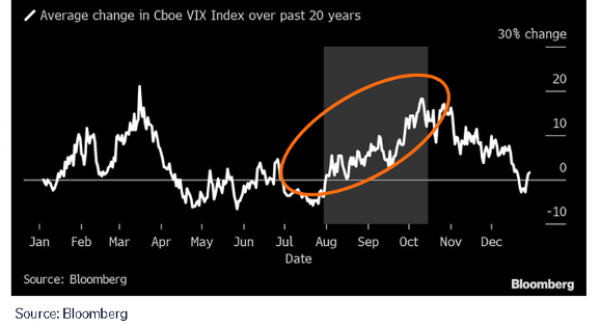

As a result, the rebound in U.S. equities looks set to continue.

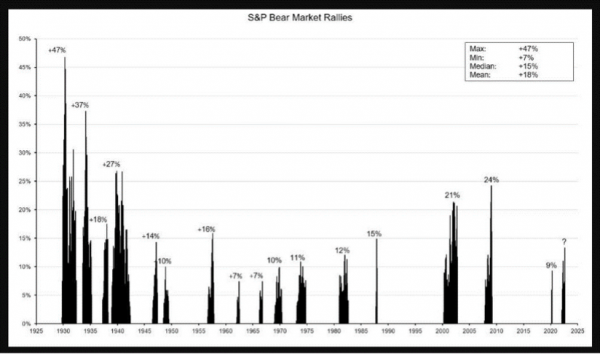

Should we conclude that the lows are behind us and that we are at the beginning of a new bull market?