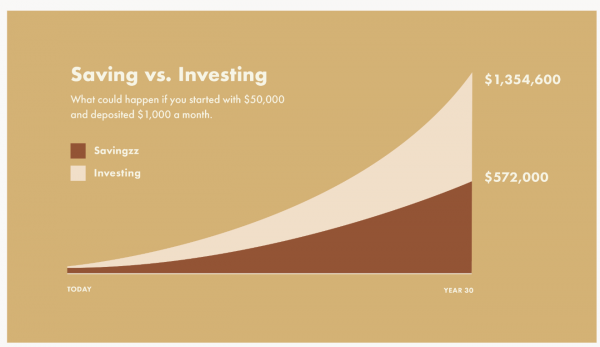

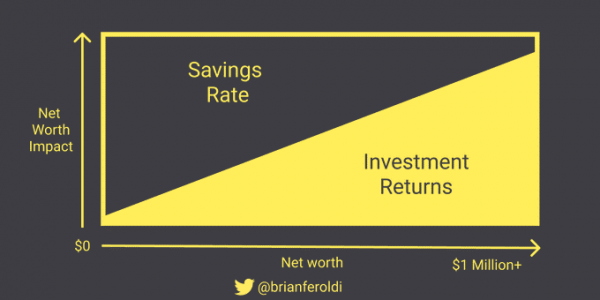

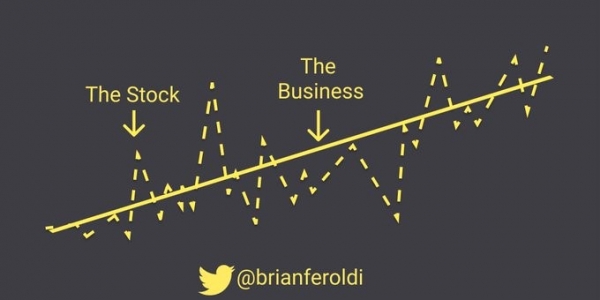

Many households think that they can protect themselves financially by saving as much as possible. This is only partly true. Saving is certainly crucial, but without investing these savings, the 'nest egg' built up over time may not be enough to make up for the lack of income from work when the time comes. By investing, however, you can create a new source of income.

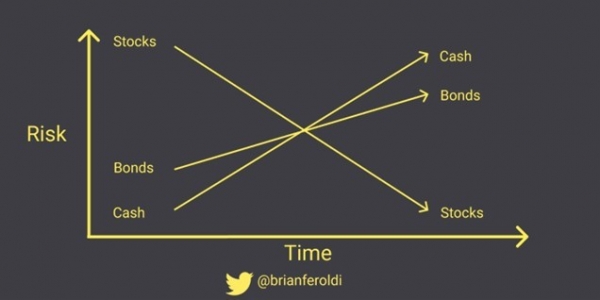

Remember that inflation, if left unmitigated, can significantly reduce the real value of your savings. Because of the time value of money, the portion of your salary saved today will be worth much less in ten, twenty or thirty years' time. Therefore, it is important to invest part of your savings in financial instruments that protect against inflation (e.g. shares, gold, TIPS, etc.).