This cycle is different as it is a supply shock and not a demand shock. Monetary policy makers need to bring down inflation by tempering demand and this inevitably leads to negative economic surprises and higher odds of recession.

That being said, we keep the view that the US economy still benefits from some “shock absorbers”. The US consumer remains in good shape, thanks in part to a strong job market (unemployment rate near record low, job openings remain well above the number of unemployed people). Wage growth partly offset the rise of inflation and households can still tap into their savings. It is true, however, that consumer sentiment has been sharply declining recently as rising prices in goods & services, the stock market rout, the surge in monthly mortgage payments (US mortgage rates have increased from 3.2% to 5.7% in 2 years) and unaffordable housing prices (+30% over the last 2 years) are weighing on the morale of US households. Still, we continue to believe that the US consumer –a key pillar of the economy – is in better shape than in 2008/2009 or 2001/2002.

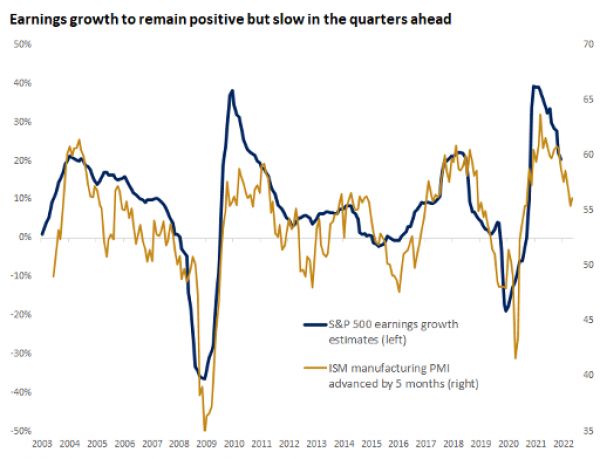

Corporate America is another shock absorber. Corporate balance sheets are in decent shape and S&P 500 earnings growth has been revised upward since the start of the month. 2023 earnings growth prospects look much more challenging but so far, the current equity bear market has been driven by a liquidity squeeze (i.e Fed tightening weighing on valuations) rather than a profit recession.

From a macroeconomic point of view, the Citigroup economic surprise index has been declining sharply over the last few months. Quarter-on-quarter annualized US GDP growth was -1.3% in the first quarter and based on the Atlanta Fed GDPNow forecast, the U.S. economy has either stagnated or contracted again in the second quarter.

If so, the economy already fits the technical definition of a recession. However, we note that the Philadelphia Fed survey of professional forecasters suggests that only 20% of them think there will be a real GDP contraction this year. PMIs remain in expansion territory. As we stated previously, we also believe that the current monetary policy tightening cycle can be partly offset by some fiscal support.

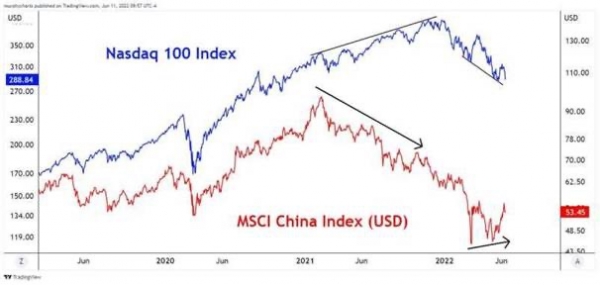

Finally yet importantly, nowadays recessions are better predicted by the state of financial markets than by the analysis of economic activity. The inversion of part of the US yield curve, defensive stocks leadership and the fact that the S&P 500 is already down by 24% from its January 2022 peak (perfectly in-line with the median drawdown observed during a recession) seem to already price in this risk to some extent. However, other market indicators are NOT pointing towards an economic recession: Two such indicators are the 10-year US Treasury bond which continues to rise, and the credit spreads which have widened but remain well below the levels observed during previous recessions.

While a prolonged, deep recession is not our central scenario, some downside risks could materialize it:

1. A financial market accident

The true risk for the economy is a financial market accident triggered by the current liquidity squeeze. Nowadays, financial markets lead the economy and not the other way around. As it already happened in the past, monetary policy tightening could also lead to a financial market accident with deep and lasting consequences on both economic activity and risk appetite. This can happen outside the US as well. It can take the form of an emerging markets crisis (Turkey, Argentina, etc.), or the end of Yield Curve Control in Japan triggering a brutal and massive end of carry trades, a deepening political crisis in Europe, etc. Dysfunctional markets, massive liquidation or deleveraging could lead to important market damages which could ultimately affect the cost of capital and push the economy into a negative feedback loop;

2. A sharp decline in housing market prices and activity

As mentioned earlier, the US consumer is a key pillar of the US economy (70-80% of GDP) and could be hit by a triple whammy effect (in addition to soaring inflation): i) a potential reversal in the job market from currently tight conditions; ii) financial markets losses; iii) higher mortgage rate hitting the housing market. Regarding the later, the rise in mortgage rates from 3.2% to 5.7% over the last 2 years at a time house prices are expensive (+30% in 2 years) could lead to a severe slowdown in housing market. This is by the way a looming risk in many countries outside the US;

3. Negative revision to earnings

In Q1, earnings and corporate margins have been surprisingly resilient, but are starting to see some negative revisions due to the slowing economic activity. A strong dollar does not help US earnings either.