Volatility on Wall Street remains elevated as the leading US stock index - the S&P 500 - has just recorded its sixth consecutive week of decline. Investors seem increasingly skeptical about the Fed's ability to achieve a "soft landing" for the economy. At its lowest point last Thursday, the S&P 500 was down nearly 18% from its highs, just 2% above the threshold that usually defines a bear market. US equity markets are not the only ones to suffer: international stocks and bond markets are experiencing their worst start to a year in decades.

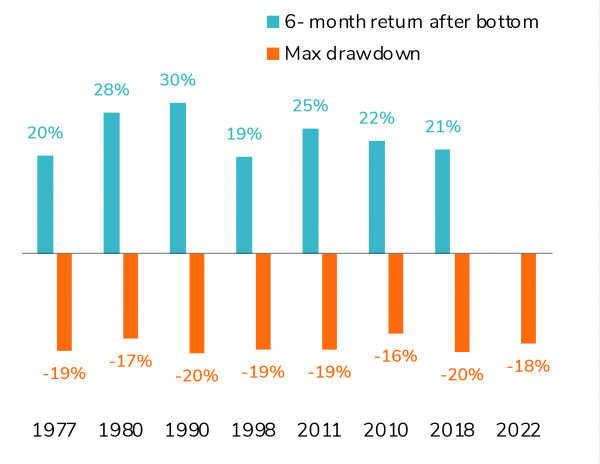

Should we give in to panic and pessimism? Such corrections have often provided great buying opportunities in the past. As the chart below shows, over the past 50 years, the S&P 500 index has fallen by around 20% several times and then rebounded dramatically - as long as corporate and economic fundamentals remained strong.