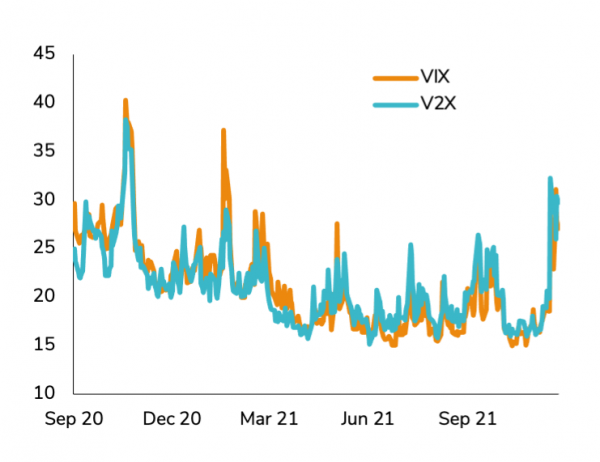

It’s been almost two years since the first case of the coronavirus was detected yet news headlines remain dominated by the pandemic. Throughout the month, markets started to worry about rising Covid hospitalisations and new restrictions in parts of Europe. The focus then shifted towards the Omicron variant. While there still are some questions surrounding Omicron, including how transmissible and vaccine-resistant it proves to be, the immediate consequence of the variant on market has been a spike of volatility.

Omicron and the Fed derail the year-end rally

Venerdì, 12/03/2021Historically, November has been the best month of the year for the stock market. While the month started off on the right foot, Fed tightening talks and Omicron anxiety spoiled the party in the last few days. Please find below the 10 stories to remember from an eventful month.

Story #1: Covid 2021

Story #2: COP 26

November was also the month of the UN Climate Change Conference (COP26) where leaders from around 200 countries met, with hopes that they would take decisive actions to limit global warming to less than 1.5°C versus pre-industrial levels. While several new announcements were made in areas including coal, deforestation and methane emissions, progress fell short of consensus expectations. The last part of the month brought renewed hopes as climate change turned out to be one of the areas where Xi Jinping and Biden agreed to work together during their virtual summit.

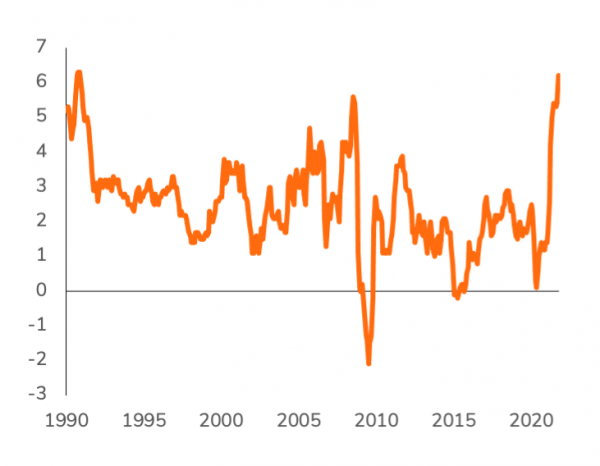

Story #3: Inflation hits record high level

The US Consumer Price Index (CPI) jumped to 6.2% year-over-year in October, its highest reading in 31 years. Meanwhile, inflation in Europe reached 4.1% year-over-year in October. On the positive side, supply chain issues seem to be gradually easing which should bring some relief next year on the inflation side. Another encouraging development was the resilience of macro data on both sides of the Atlantic. For instance, strong retail sales in the US (+1.7% in October) seem to indicate that concerns over inflation remain outweighed by other factors such as the strength of the labor market.

Story #4: Powell reelected

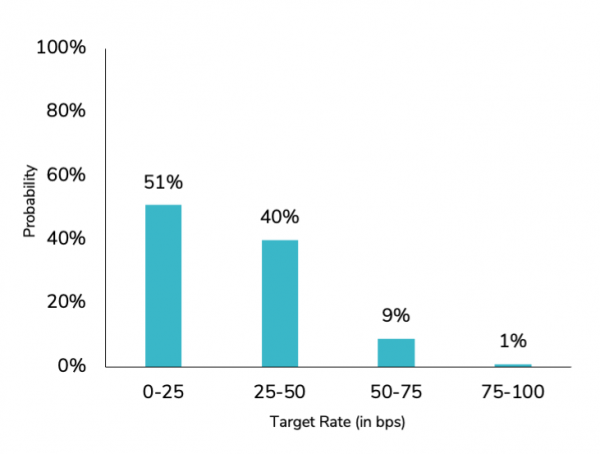

On the policy front, Jay Powell was reappointed for a four-year term as Federal Reserve Chairman. US bond yields rose on the news as he is perceived by the market as being more hawkish than his leading contender Mrs Brainard. Talks about accelerating tapering of US quantitative easing was also a key topic in November. The current plan is for monthly bond purchases to be reduced from $120 billion to zero by the end of June 2022. Several Fed members, including Powell, have talked about speeding up the pace of tapering but uncertainty around Omicron could now make that less likely in the near term. Powell’s comments were an about-face of sorts because Fed policymakers have for months maintained that higher inflation is “transitory”. Markets now see a 50% probability of at least one rate hike in early May, up from a 35% likelihood just one month ago. On the fiscal side, President Biden signed a long awaited $550 billion bipartisan infrastructure bill in order to upgrade America’s roads, bridges and railways and deploy electric vehicle charging stations across the country.

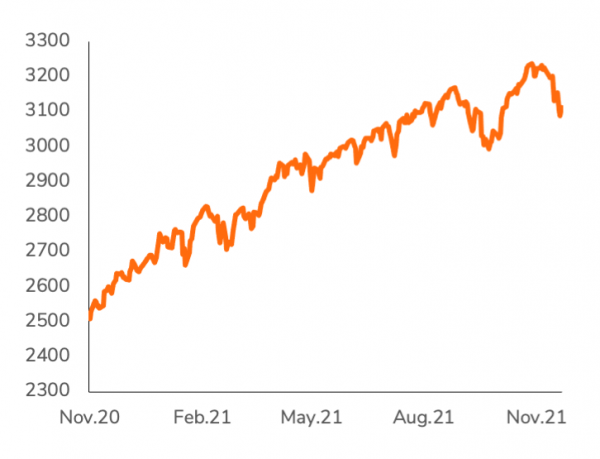

Story #5: Global equity markets in the red

Equity markets started the month on a strong foot with US stocks setting record highs after record high. But tightening talks and Omicron anxiety led to some profit taking in the last week. The MSCI World (in $) ended the month in the red (-2.2%) with the worse performance being recorded by the UK (-5.4%), Europe ex-UK (-5.1%) and Emerging Markets (-4.1%). Their weak performance reflects both the market and the currency effects (decline against the dollar). US equities outperformed but also finished in the red (-0.7%) as the S&P 500 had fallen 2.9% from its latest all-time high set during the month.

Story #6: Tech stocks outperformed in November

Within US equities, the month was the worst one since March 2020 for US small caps as the Russell 2000 index slumped 4.3%. From a style standpoint, US Growth (-0.7%) outperformed Value (-3.7%) as the Nasdaq index eked out modest gains on the month. Mega cap Tech stocks proved to be more resilient than the rest of the market. The US Technology sector is up +4.1% over the month while Energy (-4.5%) and Financial (-5.4%) stocks tumbled. It is also worthwhile to highlight that between the massive wave of Covid-19 cases in Europe and the emergence of Omicron, November was the worst month for ‘reopening’ stocks (tourism, travel, etc.) relative to ‘stay at home’ stocks since March 2020’s collapse.

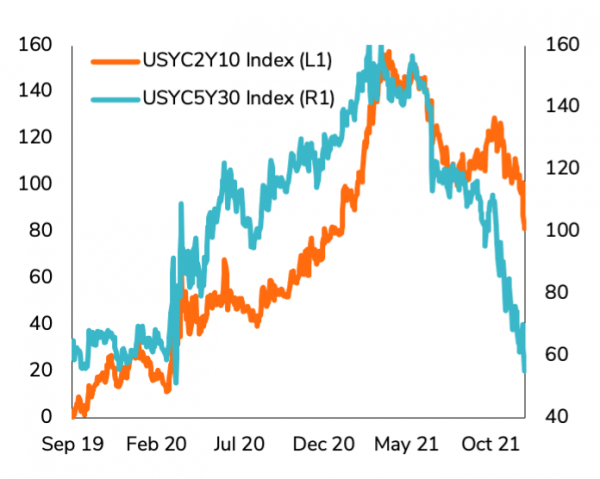

Story #7: The flattening of the US yield curve

It was a mixed month for fixed income markets. The Global Aggregate Bond index recorded a small loss over the month (-0.3%), which is still the best relative performance versus other asset classes. Euro government bonds are up 1.7% over the month while US Treasuries were up 0.8%. Emerging Markets debt (-1.4%) and US High Yield (-1.0%) were the worst performing segments. Looking at the US Yield curve, only the US 2-year yield ended the month higher while the US 30-year tumbled by 15 basis points to its lowest level of the year. As a consequence, the yield curve is flattening further with the 5s30s at its flattest level since the COVID crash.

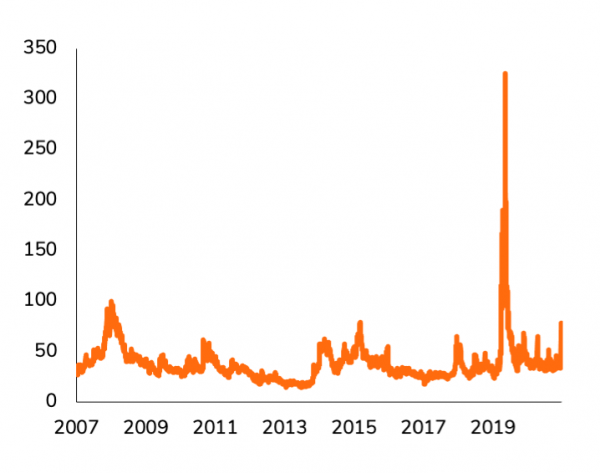

Story #8: Oil suffered its worst month since the start of the pandemic

The emergence of the Omicron variant led to the largest daily decline of Oil since oil prices collapsed to negative levels in April 2020, exacerbated by the low trading activity on Black Friday. The same day, the OVX (oil volatility) surged by nearly 100%. Brent Crude monthly performance is the worst since the start of the pandemic, leading to a -7.3% decline of the Bloomberg Global Commodity index. Indeed, the dollar strength in November did nothing to help commodities which aside from the carnage in crude, saw copper and precious metals all in the red. Note that Gold was roughly flat over the period.

Story #9: A big month for the dollar, a terrible one for the Turkish Lira

The dollar recorded strong gains against the vast majority of currencies in November. The greenback advanced by 2.3% against the euro on the back of superior macro momentum by the US economy and a more hawkish Fed. Moreover, tightening of pandemic restrictions in Europe also weighed on the euro. In Emerging markets, the Turkish lira tumbled by 40% in the last 3 weeks of the month and broke the 12 key level. This bear run reflects deep concerns over a lack of central bank independence. Note that other emerging markets currencies – Brazilian real, Polish Zloty, etc. – were also under pressure over the period.

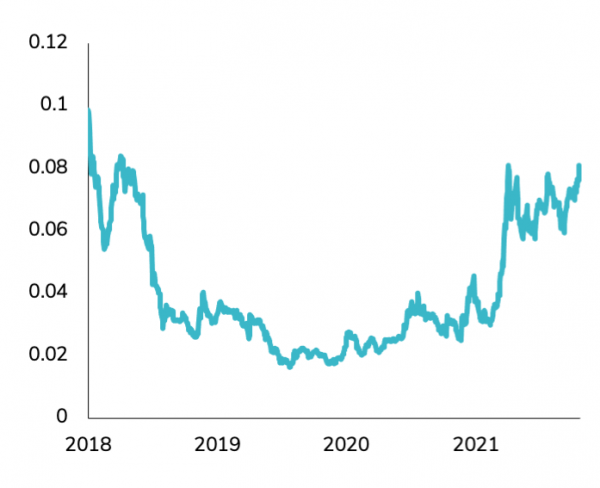

Story #10: A mixed November for cryptocurrencies

Bitcoin (BTC) hit another new all-time high when it went above $68,000 for the first time on November 10. The surge in Bitcoin’s value in recent weeks followed the much anticipated first Bitcoin ETF debuting on the New York Stock Exchange. Since mid-November peak, the price of Bitcoin has dropped below $55,000 several times. Ethereum — the next most popular crypto — notched another new all-time high ($4,800) this month. ETH (+9%) dramatically outperformed BTC (-6%) in November, pushing ETH to its strongest relative to BTC since 2018.

Final words

As we discussed in our 2022 Market Outlook (“Goldilocks faces the three bears”), we expect slower, though above potential, global economic growth in 2022. Ironically, some downside surprises to growth may be good news for investors. While inflation might stay sticky for a while, lower-than-expected growth will let central banks keep interest rates low in 2022. This would be positive for risk assets. While this ‘goldilocks’ scenario means that we favour an overweight stance on risk assets, we also believe that volatility may rise next year as markets face some downside risks. The last days of November give us a taste of what lies ahead.

Disclaimer

Il presente documento di marketing è stato redatto dal Gruppo Syz (di seguito denominato «Syz»). Esso non è destinato alla distribuzione o all’utilizzo da parte di persone fisiche o giuridiche cittadini o residenti in uno Stato, un Paese o una giurisdizione le cui leggi applicabili ne vietino la distribuzione, la pubblicazione, l’emissione o l’utilizzo. Spetta unicamente agli utenti verificare che siano legalmente autorizzati a consultare le informazioni nel presente. Il presente materiale ha esclusivamente finalità informative e non deve essere interpretato come un’offerta o un invito per l’acquisto o la vendita di uno strumento finanziario, o come un documento contrattuale. Le informazioni fornite nel presente non sono intese costituire una consulenza legale, fiscale o contabile e potrebbero non essere adeguate per tutti gli investitori. Le valutazioni di mercato, le durate e i calcoli contenuti nel presente rappresentano unicamente stime e sono soggetti a variazione senza preavviso. Si ritiene che le informazioni fornite siano attendibili; tuttavia, il Gruppo Syz non ne garantisce la completezza o l’esattezza. I rendimenti passati non sono indicativi di risultati futuri.