The race for the White House matters less than the fight to control Congress and the legislative agenda. From an economic point of view, regardless of how the Covid-19 pandemic develops, the presidential race will not alter the need to focus on recovery. Despite the geopolitical tensions and stakes for US democracy, we therefore do not see a scenario after 3 November that would significantly change the American economy’s underlying health, nor the global ‘Japanification’ picture of historically-low interest rates and growth.

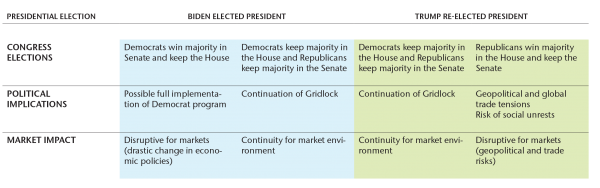

A clean sweep by one party of the Presidency, the House of Representatives and the Senate would, we believe, be the most market-disruptive outcome, by giving the next administration a free hand in shaping the US legislative agenda. But this is not our expectation. We anticipate a still-split Congress that would limit the ambitions of either president. Under current polling, we think that this Congressional status quo is the most likely result, and will be driven by disagreements over handling the pandemic.

Ignore the White House; the US’s economic outlook depends on Congress and Covid

Lunedì, 10/05/2020The world’s economies are struggling with the ravages of a year unlike any in living memory. And the US is experiencing a presidential election like no other; yet whoever sits in the White House in January 2021, Congress will determine whether the next president can implement his agenda. Ahead of weeks of market volatility, with cash and government bonds offering negative yields, we argue that investors should stand ready to grab opportunities in equities.

Polls and bookmakers all point to Democrat nominee Joe Biden winning the presidency, the Democrats retaining control of the House of Representatives and Republicans maintaining their Senate majority. President Donald Trump began to lag in opinion polls around the arrival of the pandemic in the US, which at the time of writing has killed almost 210,000 Americans.

Before March, Mr Trump was happy to run a re-election campaign on the strengths of the American economy and many investors anticipated a second Republican administration. Covid-19 has forced the President to switch tactics, stirring social and racial tensions while disclosures about his tax returns suggest that he literally cannot afford to lose. But Mr Trump cannot now avoid the subject of Covid-19. Just one month before the vote, the president has tested positive for the virus, triggering discussion around his capacity to lead, and campaign.

After the election, the greatest political risk for investors would be a contested result. Mr Trump has repeatedly cast doubt on the validity of the ballot and refused to commit to a peaceful handover. That sets the stage for legal challenges, social unrest and market volatility.

A Covid-driven consensus

In the run up to the vote, investors should not be too distracted by the noise of the presidential campaign season. For all its polarized politics, in the US the pandemic has created a broad consensus around the need for the federal government to support businesses and wages.

With the Federal Reserve committed to maintaining very low interest rates, creating historically cheap financing conditions as it absorbs rising debts through asset purchase programs, whoever is elected president is likely to have fewer fiscal constraints than his predecessors.

The partisan differences then are not about whether to compensate firms and employees for their loss of income but how much to pay. This means that fiscal policy next year can be more proactive with fewer constraints on government spending, creating far-reaching possibilities for infrastructure projects.

Importantly, both candidates’ agendas commit the US to lasting, significant public deficits. Even once a vaccine for Covid-19 is widely available, some economic sectors such as tourism, and entertainment will need continued government support, or downsize or disappear. The airline industry, for example, is not expecting a return to its pre-pandemic activity levels before 2023.

Contrasting agendas

Mr Trump arrived in office in January 2017 with an aggressive tax cut and promises to undermine the existing multilateral order. During his term, equity indices reached new highs and interest rates hit new lows. A second Trump administration may target further tax cuts, roll-over the trade tensions with China and Europe that so dominated markets before the pandemic and provoke more social unrest.

The priority for either administration will remain the still-fragile economic recovery, and until an economic recovery looks secure, a Biden presidency would have little incentive to rush toward higher taxes. Especially as long as infrastructure spending remains cheap to finance under the Fed’s current monetary policy.

Recovery permitting, Mr Biden wants to reverse a number of the business-oriented policies, as well as improve the US’s international standing. He has campaigned for a program of broad government spending on infrastructure, healthcare, clean energy and education, totaling USD 7 trillion. That would be partly financed by a combination of increased corporate and personal taxes and savings on prescription drug prices. Implemented in full, the program would significantly raise public deficits and debt.

Some of Mr Biden’s proposals, if and when eventually implemented, would therefore be negative for some stock market sectors. The prospect of raising the corporate tax rate from 21% to 28%, offsetting half of Mr Trump’s 2017 cut, would trim S&P 500 earnings by as much as a high single digit. That could undermine those sectors that most benefitted from earlier tax cuts, such as financials and industrials. Democrat promises to reform the healthcare system, a higher priority than ever during the pandemic this year, are already reflected in pharmaceutical companies’ prices. This said, a Biden administration would also look to unleash an ambitions spending plan, supporting renewable energies and large-scale infrastructure.

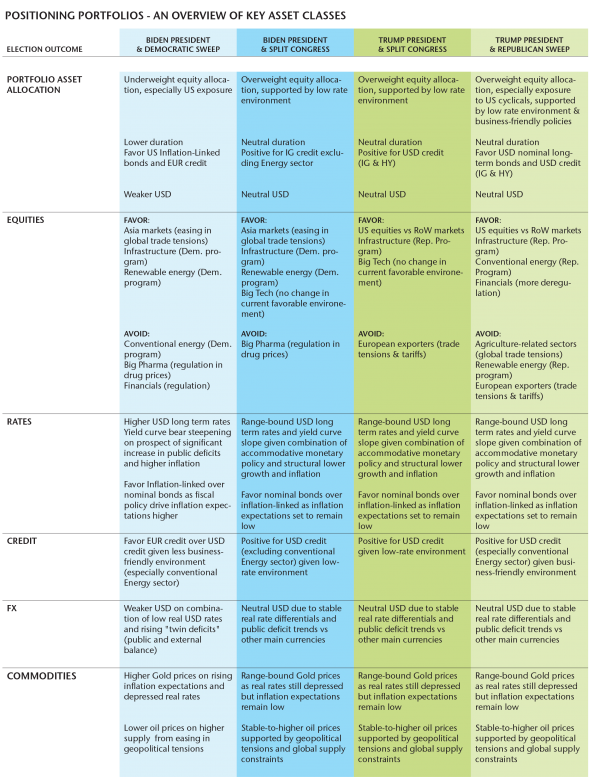

Positioning portfolios

Faced with these uncertainties, it would be highly risky to position portfolios for a specific election outcome already, especially if market volatility intensifies with a contested result.

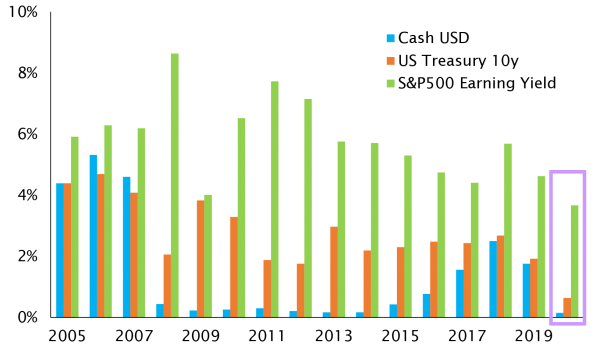

Despite the political noise, we expect the currently favorable market environment that relies heavily on fiscal support and very accommodative monetary policies, to persist. Therefore, we do not see a scenario in which it would make sense to resort to holding cash or move to zero-yielding government bonds.

We continue then to invest in investment grade credit, which offers carry yield in this context, as it enjoys the Fed’s implicit backstop. Secondly, we believe that it makes sense to hold diversifying assets such as gold, long-term government bonds or instruments that can benefit from the high volatility levels of coming weeks. We are keeping some exposure to equities, preferring quality companies with high levels of long-term free cash flow. Any period of intense volatility in the weeks ahead will offer opportunities to build or add exposure to such names.

This election’s vitriol, the danger of social unrest, uncertainties over the president’s Covid infection and a Supreme Court appointment that threatens existing healthcare policies, will all keep financial markets on alert in the coming weeks. So while stock markets continue to benefit from very low rates and plentiful liquidity, they may react abruptly to the election outcome, depending largely on the make-up of Congress.

Disclaimer

Il presente documento di marketing è stato redatto dal Gruppo Syz (di seguito denominato «Syz»). Esso non è destinato alla distribuzione o all’utilizzo da parte di persone fisiche o giuridiche cittadini o residenti in uno Stato, un Paese o una giurisdizione le cui leggi applicabili ne vietino la distribuzione, la pubblicazione, l’emissione o l’utilizzo. Spetta unicamente agli utenti verificare che siano legalmente autorizzati a consultare le informazioni nel presente. Il presente materiale ha esclusivamente finalità informative e non deve essere interpretato come un’offerta o un invito per l’acquisto o la vendita di uno strumento finanziario, o come un documento contrattuale. Le informazioni fornite nel presente non sono intese costituire una consulenza legale, fiscale o contabile e potrebbero non essere adeguate per tutti gli investitori. Le valutazioni di mercato, le durate e i calcoli contenuti nel presente rappresentano unicamente stime e sono soggetti a variazione senza preavviso. Si ritiene che le informazioni fornite siano attendibili; tuttavia, il Gruppo Syz non ne garantisce la completezza o l’esattezza. I rendimenti passati non sono indicativi di risultati futuri.