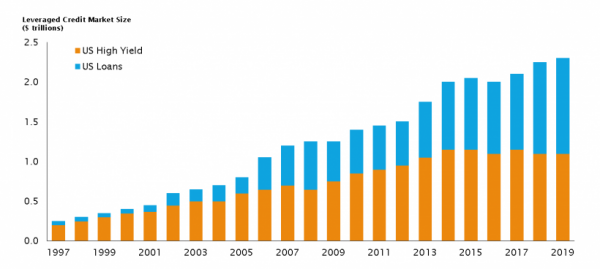

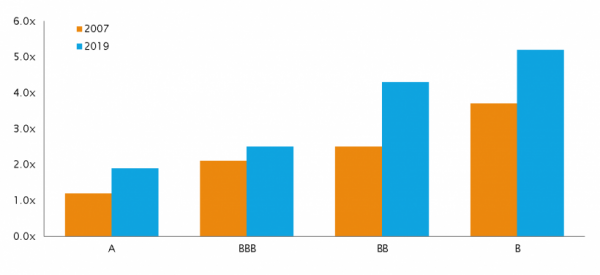

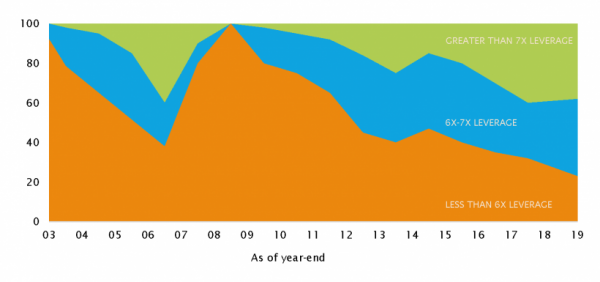

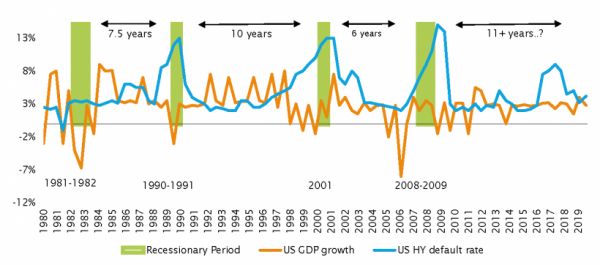

We have been quite cautious around peak market valuations and excess cash invested in the system for some time already as evidenced again in the same article: “With many assets fairly priced, high debt levels, shallow liquidity and the increasing dominance of passive strategies, market conditions are not without risks”

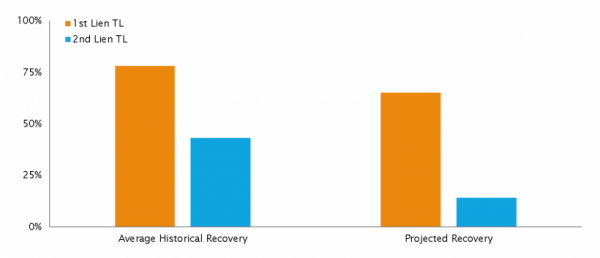

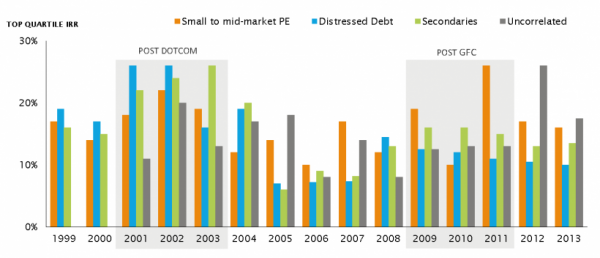

Obviously, we couldn’t predict the impact of the COVID-19 pandemic nor its timing, but were convinced that valuations were approaching dangerous levels. The higher they are, the more extreme the next correction would be. We designed our multi-strategy program last year to build a value-driven and very resilient sample portfolio across the market cycles. We therefore included special situations which would not only protect capital in a downtown but actually benefit in a crisis by using strategies such as distressed and secondary’s, amongst others.

Nobody really knows yet how this will play out. In 1919, the world counted over 17 millions deaths caused by Spanish influenza, much higher than the casualties caused by the first world war that had just ended. The measures and means were different, but it is not yet possible to predict the outcome with any certainty. Dealing with a pandemic is not trivial. Until it is fully gone, it still burns somewhere, like embers in a fire, which could start again on a windy day.

While we have no crystal ball, and are obviously not epidemiologists, assessing the length of the lockdown, or future waves of contagion, remains a probability game. However, we believe that the economic situation will take some time to get back to normal, probably years, and that we all need to get used to a post COVID-19 environment. As we highlighted last year, a Japanification of the world is more than ever our central scenario, with various implication for portfolios, asset allocation, and investment strategies.